In your journey of life, you have travelled, lived and worked in more than one country. Now that you have acquired your assets, you want to make sure they are protected from tax pitfalls and go to your loved ones or charity of choice. Losing your assets as you transition between two countries would be devastating. That's why understanding cross-border estate planning and cross-border financial planning is critical.

Please note that this article is general in nature. We recommend you speak to qualified cross-border tax, legal and financial planning experts to understand your situation.

When our clients come to us, an important goal for them is understanding how to transfer wealth during their lifetime and after their death.

Ideally, you want to plan. Arranging who will receive your assets when you pass and providing clear end-of-life directives will reduce family distress when you are gone. When you are considering your estate and investments, you want to have an estate plan that considers the beneficiaries and assets in multiple countries.

The documents you will likely want are a will, financial power of attorney and a durable power of attorney for healthcare. You may consider various trusts, but you will need to know the tax implications of these in the country where your assets are held and where you reside. The rights accorded to a beneficiary depending on where they reside, and the tax jurisdiction is also fundamental.

If you are a US person, the global taxation of citizens and green card holders make planning ahead of time even more critical. You may have children from a prior marriage and others from a current marriage. Succession planning becomes crucial.

First, you want to make sure you have your beneficiary designations on your registered accounts, such as RRSPs and IRAs. When planning a transfer of your estate across the US-Canada border, you must know where you need a will and in which country your executor will be.

You may wonder if you need two wills if you have assets in both countries. It may be true that having a will in the country where your property is owned is ideal. However, you need to consider that if you have two wills, your lawyers should work together so that one will doesn't revoke the other.

Another consideration with cross-border estate planning is the use of a trust. In simple terms, a trust is a legal vehicle that allows a third party, the trust, to hold the assets on behalf of the beneficiary(s).

Estate planning can be complicated when you are a Canadian and reside in Canada. But when you add the intricacy of being considered a US person and perhaps having assets in both countries, the risk is much higher of making costly mistakes.

Thinking about no longer being able to take care of your affairs may be unpleasant. However, with proper planning, your wishes will be easier to follow. Your beneficiaries may be able to avoid the distress of spending years trying to sort out your affairs.

Working with a cross-border financial planning team who can help guide you makes estate planning simpler. You will feel confident that you have done your best to take care of your loved ones.

A US revocable living trust may not be a good option for a Canadian resident, regardless of whether you are considered a US person. It may cause tax and estate problems. As always, speak to a qualified tax and law professional to understand your situation.

Many people like to use a trust to avoid probate and the process of having the public be able to know all your probable assets once you have passed. A trust helps to avoid the cost and time of assets being tied up in probate. However, when you have a cross-border estate, it isn't always that simple.

The US government recognizes a US revocable living trust as a disregarded entity, which means it is not taxed as an entity separate from you.* If a Canadian resident controls the US revocable living trust or if a Canadian resident contributed to the trust, it may be considered a Canadian resident trust. As a Canadian resident trust, it would be taxable on its worldwide income. It is viewed as an entity separate from you.

Please note that this is not taking into consideration deemed residency, which adds complexity. This section is meant to be general in nature, so please speak to a qualified professional about your particular situation.

The next consideration that may arise is the option of a cross-border trust (CBT). Because the CRA and IRS recognize a cross-border trust as a disregarded entity, it means the business is not separated from the owner for tax purposes in both countries. Therefore having a CBT may help to avoid double taxation as foreign tax credits are easier to use.*

Whether you are a Canadian or a US person residing in Canada, you need to consider the tax, legal and administration factors of owning foreign property in the US. Many people want to use trusts to avoid the costly and lengthy probate processes or gain creditor protection. Still, only specific options may work when residing in Canada. You will need to speak to your cross-border lawyer to identify the best path forward.

If you are a foreign person, you may be subject to withholding tax on your US property's selling price according to Foreign Investment in Real Property Tax Act (FIRPTA).

Even when you reside in Canada, the property is owned in the US, so the IRS has the first right to tax the gains. You will also still need to report your gains or loss to the CRA as a Canadian resident. This FIRPTA is taken to ensure you pay your US income tax obligation.

Once you file your US tax return, it may be refunded from the IRS if there is a balance owed to you. Also, the Canada-US Income Tax Treaty helps you to avoid double taxation. You can likely utilize foreign tax credits to offset the amount paid to the IRS. You will also need to consider where you are a citizen, a resident and your domicile.

You would need to speak to a cross-border accountant to understand your particular situation, as there may be exceptions to the withholding tax.

You may be considering whether or not to use a cross-border trust (CBT). While you would need to consult with a lawyer to consider your particular situation, I will explain why there is an increase in the popularity of CBTs.

When you pass on your property through a trust, you avoid probate, and the property goes directly to your heirs. First, it is important to understand what probate means. When you pass away, anything that cannot have a direct beneficiary designation will go to your heirs through a will. Before it transfers, it goes through the process of probate.

Probate is the legal process where the court determines the validity and wishes of your will. Probate can be costly and is time-consuming. During probate, your probate assets are essentially frozen until the court determines the validity of your will and settling of your estate. This would include property and assets on either side of the border.

Another downside of probate is that this court process is public. Anyone can see your assets' value, and probated wills are public records filed in a Register of Wills in the US. It would likely be registered with the probate courts in Canada, and anyone can apply for a copy.

You can see why many families prefer to use a trust to avoid probate.

We have had several clients come to us who have inherited a limited liability corporation (LLC). It is a structure created in the US that does not have an equivalent in Canada. In the US, an LLC allows the owners to get taxed when they earn income from the LLC. The actual LLC does not file a tax return as it is considered a disregarded entity. In Canada, an LLC isn't recognized. It is seen as a corporation, and the CRA would tax the corporation.

This means you likely cannot use the foreign tax credits against each other because one would be taxed in your name and the other as a corporation. This means you are at risk for double taxation.

Please speak to a cross-border lawyer and cross-border accountant to understand your situation more clearly and avoid this issue.

There is no gift tax in Canada, but if you gift investments or real estate, there may be a deemed disposition. This means that if you gifted a house, the CRA sees it as though you sold the property at fair market value (FMV), and you would owe any tax on the capital gain.

In the US, you can give up to USD 15,000 each year to any number of beneficiaries and avoid gift tax. You will not face tax until you reach your maximum lifetime exemption, which is USD 11.7 million.

An estate tax is charged to the decedent estate when assets pass to beneficiaries. The current 2021 federal estate tax threshold is USD 11.7 million. For married couples, this is double at USD 23.4 million. This means if your estate is worth less than this at death, there will not be a federal estate tax charged.

You may be able to gift money to beneficiaries during your lifetime to reduce your estate value. But be careful to look up state taxes as some states charge estate tax and inheritance tax above various thresholds.

Keep in mind that the estate tax will go back to USD 5 million plus inflation in 2026. President Biden has suggested that the estate tax be reduced by 50% of its current level. This reduction could impact many more people.

Resources:

A dynasty trust is usually created to pass wealth from one generation to another without transfer taxes such as estate tax, gift tax or generation-skipping tax. Keep in mind that if the dynasty trust is set up in the US and the beneficiaries of the trust are Canadian residents (or if the contributor is a Canadian resident), it may be deemed to be a Canadian resident trust as well as a US resident trust. This can cause tax complications.

It is essential to speak to a qualified cross-border lawyer and cross-border accountant to see if this may be an option for you.

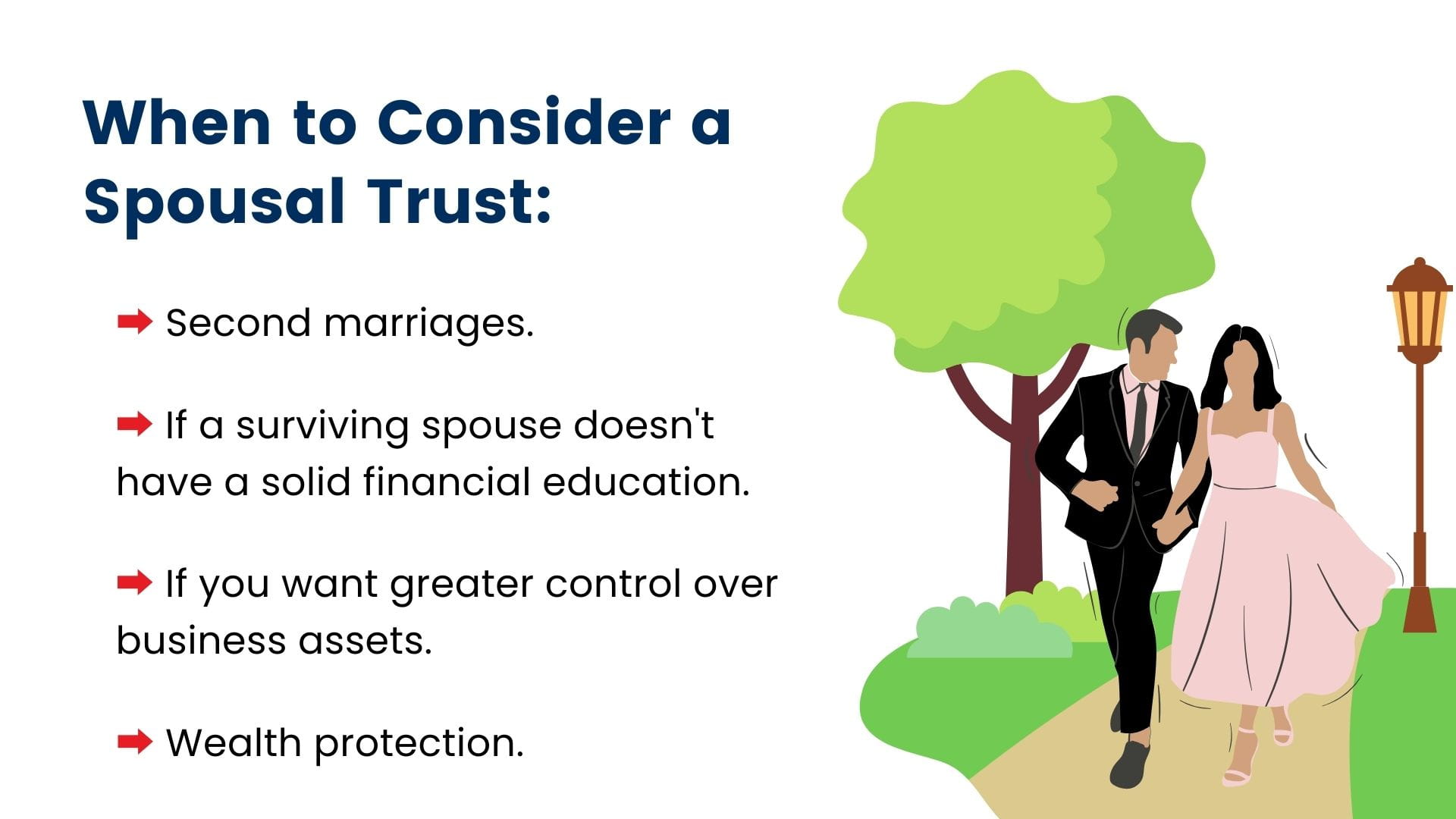

A Canadian testamentary spousal trust is a trust designed under the Income Tax Act to roll over assets to your spouse or common-law partner tax-free. The provisions in your will create this trust. Your surviving spouse is entitled to all the income from the spousal trust. Nobody else can use or receive any income or capital during the surviving spouse's lifetime.

Common situations where spousal trusts may be considered are:

There are more strategies and options than mentioned in this article, as well as other trust options. Estate planning is complex and requires working with a cross-border wealth management team and a cross-border lawyer.

At SWAN Wealth Management, we work with a network of cross-border lawyers when doing Estate Planning for our clients. You will need to speak to a qualified lawyer about your personal situation. It is important to understand that to create a cohesive estate plan; you need your financial advisor, lawyer and accountant to work together. All members of your team need to understand your goals.

At SWAN Wealth, we work with Raymond James Trust (Canada) (RJTC) for trust services. RJTC provides trust services to help safeguard your legacy and ensure your wishes are followed. You can appoint (RJTC) as the executor and trustee to administer your estate and help you make the best decisions. Our trustee services can help guide with technical, tax and reporting and the administration of trusts.

If you’re planning a cross-border move or you’ve already moved from the US to Canada and need help simplifying and optimizing your finances, then please get in touch. At SWAN Wealth we specialize in cross-border financial planning and wealth management. We would be happy to ensure that you’re onside with the IRS while protecting your investments and retirement assets.

If you’re planning a cross-border move, these articles and guides will help you simplify your move and make sure you’ve got everything covered.

Tiffany Woodfield is a dual-licensed financial advisor and the co-founder of SWAN Wealth Management, along with her husband, John Woodfield. Tiffany specializes in advising clients who live both in Canada and the United States and need to simplify their cross-border financial plan, move their assets across the border, and optimize their investments so they can minimize their tax burden. Together Tiffany and John Woodfield help their clients simplify their cross-border finances and create long-term revenue streams that will keep their assets safe whether they live in Canada or the US.

Book a 15-minute introductory call with SWAN Wealth Management. Click here to schedule a call.